CORPORATE ACTION

TerraCycle’s Loop Could Be A Game Changer For CPGs In Their Battle With Plastic Use But Is There A Hidden Agenda?

At the World Economic Forum in January 2019, TerraCycle unveiled Loop, a circular reusable packaging platform for consumer packaged goods companies. Mid-2018 TerraCycle discussed plans for its “disruptive ecosystem for CPGs” that aimed to eliminate waste entirely.

At the World Economic Forum in January 2019, TerraCycle unveiled Loop, a circular reusable packaging platform for consumer packaged goods companies. Mid-2018 TerraCycle discussed plans for its “disruptive ecosystem for CPGs” that aimed to eliminate waste entirely.

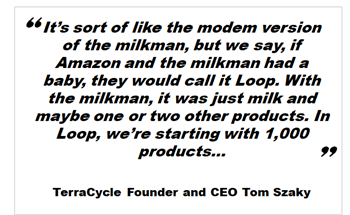

The core idea is simple. Loop seeks to be a modern day milkman, shipping products via UPS in a reusable padded container for them to be returned when empty for cleaning and reuse. Products are dispensed from reusable metal and plastic containers that CPG companies have redesigned for this purpose. It says it will initially focus on homes but ultimately work with retail stores and their e-commerce platforms.

TerraCycle aims to launch May 2019 in New York and Paris and has secured a range of high-profile CPG partners, including P&G, Unilever, Nestlé, KFC and Coca-Cola. These companies have redesigned packaging of some brands to work with Loop. For example, Nestlé Haagen-Dazs developed a stainless-steel ice cream container, while P&G’s Crest Platinum will be available in a refillable glass bottle with a stainless-steel cap, all protected by a silicone sleeve.

Doubts

Greenpeace accuses the CPGs of greenwashing and doubts they will really change their business models. Others question the green credentials of the program – will the cleaning and shipping take more energy than just using recycled plastic?

Analysts question the viability of the consumer proposition. Pricing is unclear, but one report suggests consumers will shop online and pay a deposit ($1 to $10) per container as well as shipping charges, which apparently will start at about $20 (!) but fall with every item added. These are eye watering numbers for a business that runs on slender margins.

Bigger questions

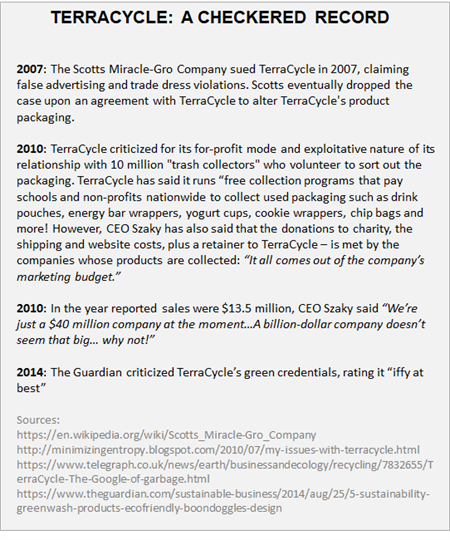

To our mind, something doesn’t fit. Loop is a great idea but TerraCycle is a small recycling company from Trenton, NJ with a checkered and somewhat controversial history (sidebar). Yet the world’s leading CPG companies are heaping praise on it. Here are comments from archrivals P&G and Unilever:

“We’re proud to partner with TerraCycle as the first CPG company to be part of this transformative program, which is just one of the many ways we are delivering on our Ambition 2030 goals to accelerate sustainable innovation and drive circular solutions” (Virginie Helias, P&G’s Vice President and Chief Sustainability Officer)

“We want to put an end to the current “take-make-dispose” culture and are committed to taking big steps towards designing our products for re-use. We’re proud to be a founding partner of Loop, which will deliver our much-loved brands in packaging which is truly circular by design” (Alan Jope, CEO of Unilever)

We did a little research into TerraCycle and Loop to find out more.

TerraCycle

TerraCycle started in 2003 as a waste recycler and has experimented with different business models over the years. CEO and founder, Tom Szaky, is charismatic with a gift for PR and grand designs. Yet the company remains small, with 2016 revenues reported just under $20 million.

Notably, its US business, which accounts for 70% of total sales, is undergoing a stock offering that will allow some investors to cash out, with some residual funds used for expansion. The rights issue started January 30, 2019 (six days after Loop was announced at WEC) with an end-date of January 30, 2020 or when the maximum raise of $25 million is reached.

But a more attractive objective for them would be to create an entirely new channel, and what a channel it would be. It’d be beyond the reach of retailers and Amazon and would allow the CPGs to build direct links with consumers, a long-cherished goal. And it would lock them in. Containers would tie consumers to specific brands with possibly high switching costs.

This strategic goal hasn’t been mentioned in any of the company documents, press or commentary we have seen but it would explain how such a small company could persuade so many leading CPGs to join an unproven venture.

It’s telling that TerraCycle is divesting of its core business just as Loop is getting going. TerraCycle's management want to reduce exposure to its core business as it focuses on Loop, its great new hope. It likely knows Loop will take management attention and its core business will suffer.

Strategic sleight of hand?

We suspect TerraCycle has offered options in Loop to partnering CPGs. Sure, the CPGs are attracted by shifting at least part of their sales to a zero-waste model: it looks good, shows they’re trying and will make for great PR.

But a more attractive objective for them would be to create an entirely new channel, and what a channel it would be. It’d be beyond the reach of retailers and Amazon and would allow the CPGs to build direct links with consumers, a long-cherished goal. And it would lock them in. Containers would tie consumers to specific brands with possibly high switching costs.

This strategic goal hasn’t been mentioned in any of the company documents, press or commentary we have seen but it would explain how such a small company could persuade so many leading CPGs to join an unproven venture.

Did Nestlé just give the game away?

Most CPG companies talk of being a “partner” of Loop but in a press release Nestlé says it is a “founding investor and partner of Loop,” suggesting it has an equity stake in the venture.

It’s hard to believe Nestle is the only investor, especially given TerraCycle has closer ties with other companies, notably P&G. Much more likely is that the CPGs are working together and have provided initial funds and secured options to purchase some or more of the company down the line. It makes sense for them to play this down right now, but in a year or two, if things look promising and they exercise their options, it could look like a masterstroke. They’ll be proud owners in a new, exciting and entirely sustainable business model.

CORPORATE ACTION: Coca-Cola

Coca-Cola Amatil To Stop Using Plastic Straws And Stirrers In Australia

The new straws will be supplied by BioPak and Austraw. BioPak is an Australian company that is reducing tree-based paper and fossil fuel-based plastic used in foodservice wares by offering an eco-friendly alternative. Austraw is also Australian and undergoing a transition, rebranding as Bygreen since it stopped selling single-use plastic items at the end of 2018.

[Image Credit: © Coca-Cola Amatil]

Coca-Cola CEO Praises Progress Made, Encourages Other Companies To Use Its PlantBottle Technology

At closing comments to the World Economic Forum Annual Meeting, Coca-Cola CEO James Quincey, talked about progress made and how “Suddenly, a world without waste is possible”. He mentioned how the company’s global recovery rate is now at 59%, how in some countries it uses more than 25% recycled materials in its bottles and cans and that in four countries, it developed a plastic bottle made from 100% recycled material.

At closing comments to the World Economic Forum Annual Meeting, Coca-Cola CEO James Quincey, talked about progress made and how “Suddenly, a world without waste is possible”. He mentioned how the company’s global recovery rate is now at 59%, how in some countries it uses more than 25% recycled materials in its bottles and cans and that in four countries, it developed a plastic bottle made from 100% recycled material.He invited other companies to use its PlantBottle technology that produces the world’s first, fully-recyclable PET plastic bottle made partially from plants. He did not make it clear the terms under which it would offer this technology.[Image Credit: © The Coca-Cola Company]

CORPORATE ACTION: Danone

Danone Expands Supply Agreement With Loop Industries, And Experiments With Upscale Evian Bottle

Danone announced a multi-year agreement under which it will purchase 100% sustainable and upcycled PET from Loop Industries' joint venture facility with Indorama Ventures Limited in the United States for use in brands across its portfolio including Evian. Danone has worked with Loop Industries for some years and this new agreement extends the relationship to include Loop branded PET resin.

Separately, the Danone water brand, Evian, showcased luxury water bottles designed by its new ‘creative director for sustainable design’, Virgil Abloh. The glass water bottle is made by sustainable water brand SOMA and has a silicone sleeve with the Evian logo and the words “Rainbow Inside”.

The limited-edition bottle was launched at New York Fashion Week, an event Evian has long sponsored. It was made available for $48 from MATCHESFASHION.COM but quickly sold out and there is no indication whether Evian will make more.

With plastic water bottles facing considerable consumer pressure, Evian’s move perhaps points the way to an alternative future revenue steam; an upscale and coveted reusable water bottle could provide supplementary income and help reposition the brand as sustainable.

[Image Credit: © Danone]

Separately, the Danone water brand, Evian, showcased luxury water bottles designed by its new ‘creative director for sustainable design’, Virgil Abloh. The glass water bottle is made by sustainable water brand SOMA and has a silicone sleeve with the Evian logo and the words “Rainbow Inside”.

The limited-edition bottle was launched at New York Fashion Week, an event Evian has long sponsored. It was made available for $48 from MATCHESFASHION.COM but quickly sold out and there is no indication whether Evian will make more.

With plastic water bottles facing considerable consumer pressure, Evian’s move perhaps points the way to an alternative future revenue steam; an upscale and coveted reusable water bottle could provide supplementary income and help reposition the brand as sustainable.

[Image Credit: © Danone]

CORPORATE ACTION: Henkel

Henkel, Founding Member Of New Global “Alliance To End Plastic Waste,” Commits To Circular Value Chain

Hans Van Bylen, Henkel CEO, claims the company has “ambitious targets for sustainable packaging,” saying 100 percent of its packaging will be recyclable, reusable or compostable by 2025. In addition, Henkel ‘aims’ to use 35 percent recycled plastic for its consumer goods products in Europe.

Hans Van Bylen, Henkel CEO, claims the company has “ambitious targets for sustainable packaging,” saying 100 percent of its packaging will be recyclable, reusable or compostable by 2025. In addition, Henkel ‘aims’ to use 35 percent recycled plastic for its consumer goods products in Europe.

In a press release, Henkel touted efforts beyond being a founding member of AEPW. These include being a member of the New Plastics Economy (NPEC), an initiative led by the Ellen MacArthur Foundation that brings key stakeholders together to redesign plastics use on the “circular economy” principle.

Also, Henkel recently invested £5 million into Circularity Capital, an impact fund that seeks to promote a circular economy, and since 2017 it has worked with Plastic Bank, a social enterprise that works with local communities to collect plastic waste in exchange for money, goods, or services.

[Image Credit: © Henkel AG]

CORPORATE ACTION: KFC

KFC Gives Global Pledge To Eliminate Non-Recoverable Or Non-Reusable Plastic-Based Packaging By 2025

In a new undertaking, KFC announced a new global sustainability commitment that all plastic-based, consumer-facing packaging will be recoverable or reusable by 2025, a move that will involve redesigning the majority of its own-brand packaging lines. With its more than 22,000 restaurants in over 135 countries, KFC CEO, Tony Lowings, says “KFC is in a position to have a real impact on how the industry approaches waste and packaging management overall."

In a new undertaking, KFC announced a new global sustainability commitment that all plastic-based, consumer-facing packaging will be recoverable or reusable by 2025, a move that will involve redesigning the majority of its own-brand packaging lines. With its more than 22,000 restaurants in over 135 countries, KFC CEO, Tony Lowings, says “KFC is in a position to have a real impact on how the industry approaches waste and packaging management overall."

KFC will take a flexible approach and work with franchisees to define and implement their own sustainability agenda to address the unique needs of local markets and customers. Markets will also continue to have their own, additional local sustainability goals that vary based on local market conditions and regulations. This will mean some markets move faster than others. Several have already announced plans to reduce the use of certain plastics, including: KFC Singapore's intention to stop providing plastic straws and cup lids in its 84 restaurants; KFC Romania's and France's common goal to replace all plastic straws with paper; and KFC India's removal of consumer plastic bags from their restaurants and ongoing transition to sustainable alternatives for plastic cups, bowls, sporks and straws.

Separately, KFC has committed to global packaging innovation by signing on as a supporting partner with NextGen Consortium. NextGen is a multi-year, multi-industry global consortium that aims to advance the design, commercialization, and recovery of food packaging alternatives.

[Image Credit: © KFC Corporation]

CORPORATE ACTION: Nestlé

Nestle Outlines Steps It Will Take To Combat Plastics Pollution

Nestlé announced it will begin to eliminate all plastic straws from its products beginning in February and replace them with straws made from alternative materials, like paper, or relying instead on “innovative designs.” The announcement is part of its commitment to “embrace multiple solutions" to make 100 percent of its packaging recyclable or reusable by 2025, with a goal of eliminating plastic waste.

Nestlé announced it will begin to eliminate all plastic straws from its products beginning in February and replace them with straws made from alternative materials, like paper, or relying instead on “innovative designs.” The announcement is part of its commitment to “embrace multiple solutions" to make 100 percent of its packaging recyclable or reusable by 2025, with a goal of eliminating plastic waste.

The company will also start rolling out paper packaging for Nesquik in the first quarter of 2019 and for the Yes! snack bar brand in the second half of 2019. Smarties will start introducing plastic-free packaging in 2019, while Milo will launch paper-based pouches in 2020. Lastly, Nestlé Waters has pledged to increase the recycled PET content in its bottles to 35 percent by 2025 at the global level and will reach 50 percent in the U.S.

Nestle has formed various alliances to tap new materials. It formed a partnership with Danimer Scientific to develop a marine biodegradable and recyclable bottle for its water business and initiated a collaboration with PureCycle Technologies to produce food-grade recycled polypropylene, a polymer commonly used for packing food in trays, tubs, cups and bottles.

In 2018, Nestlé also established its Institute of Packaging Sciences, which will look at alternative packaging, including compostable polymers and paper-based solutions. These moves come as part of Nestlé’s various commitments to addressing plastic pollution. It joined the Global Ghost Gear Initiative in 2018 and was the first food company to sign up to Project STOP, a 2017 Indonesian initiative to implement circular economy solutions at scale to marine plastic pollution in Southeast Asia.

CORPORATE ACTION: Unilever

Ben & Jerry's To Eliminate Single-Use Plastic In Scoop Shops Worldwide

Walmart Canada Announces New Plastic Reduction Commitments

CORPORATE ACTION: Other

Trend Update: More Companies Move To Reduce Use Of Plastic

Companies worldwide are moving to mitigate plastic use in their packaging. Here are a few recent examples:

A&W Canada marked its end of using plastic straws by using its remaining stock in a 35-foot-long sculpture, called “Change Is Good.” The sculpture used 140,000 straws and was put on display outside Toronto’s Union Station. A&W, Canada’s second-largest hamburger chain, became the first North American chain to completely stop using plastic straws, instead switching to biodegradable paper ones.

Following a review of consumer attitudes at six stores where it trialed a ban of plastic bags, New England grocer Big Y Foods [https://www.bigy.com/], has decided to phase out single-use plastic bags by the end of 2020. Consumers said they supported the ban as well as environmentally responsible business practices. Richard D. Bossie, Big Y vice president of store operations said “Our customers and the communities we serve have made it quite clear that they prefer more environmentally friendly alternatives.” Big Y estimates it uses 100 million plastic bags each year.

Thai food producer Charoen Pokphand Foods made a series of announcements regarding its packaging. On January 11 it committed to make all its packaging reusable, recyclable or compostable by 2025 for Thailand operations and by 2030 for its overseas operations. CP Foods also said it will cut waste disposal to landfill and incineration by 30% by 2020 against 2015 levels. Also, on January 16, the company launched a “Say No to Plastic Bag” campaign that it hopes will lower demand for plastic bags by 3 million annually. It will offer ‘exclusive cool bags’ to customers who spend over 200 baht.

Sun Basket Meal Kit Packaging Is 100% Recyclable Or Compostable

The meal kit market has exploded and in the US exceeds $5 billion, but with the rise came concerns about over packaging. San Francisco-based Sun Basket, which prepares some 2 million certified-organic meals each month, has a zero-waste mission and uses only 100% recyclable or compostable material. While some of its packaging can be dealt with easily – its corrugated shippers are made from a blend of fibers and are curbside-recyclable – other elements require work by the consumer. Gel packs have a polyethylene container and plastic bags are used for some items, but the company says both forms of plastic can be recycled.

The meal kit market has exploded and in the US exceeds $5 billion, but with the rise came concerns about over packaging. San Francisco-based Sun Basket, which prepares some 2 million certified-organic meals each month, has a zero-waste mission and uses only 100% recyclable or compostable material. While some of its packaging can be dealt with easily – its corrugated shippers are made from a blend of fibers and are curbside-recyclable – other elements require work by the consumer. Gel packs have a polyethylene container and plastic bags are used for some items, but the company says both forms of plastic can be recycled.The company continues to innovate its packaging and since fall 2017 switched its insulation from 100% PET to a paper-based product from Sealed Air Product Care, TempGuard.

[Image Credit: © Sun Basket]

CAMPAIGNS, COMMITMENTS & NGOs

How2Recycle Gaining Traction, 45% Growth In Users

Launched in 2012, How2Recycle label is growing strongly with 80 new products daily and a 45% increase in the number of retailers and brands using the label in 2018. 120 brand owners and retailers now use How2Recycle.

Launched in 2012, How2Recycle label is growing strongly with 80 new products daily and a 45% increase in the number of retailers and brands using the label in 2018. 120 brand owners and retailers now use How2Recycle.The How2Recycle label, which is managed by GreenBlue, seeks to communicate recycling instructions with a clear, well-understood, and nationally harmonized label. It aims to increase the availability and quality of recycled material as well as follow Federal Trade Commission Green Guides.

Accolades for the initiative include, among others, 2018 recognition as a Finalist in MIT Climate CoLab's contest Shifting Attitudes and Behaviors to Address Climate Change.

The labeling system is used by various leading brands including General Mills, Hasbro, Nestlé, Target, Wal-Mart, and food and beverage continues to be its strongest product segment.

Growth is driven by rising concern for the circular economy and ethical consumers keen to recycle.

GreenBlue point out that How2Recycle is substantially more than just a labeling program. It helps participant brands track, measure and improve the recyclability of their packaging portfolio and makes specific packaging design recommendations to improve recyclability. The How2Recycle label, which is US-based, is now available for Canada.[Image Credit: © How2Recycle]

ALLIANCES, PARTNERSHIPS & JVs

Alliance To End Plastic Waste Launched With $1.5 Billion To Find Solutions

On January 16, 2019, Alliance to End Plastic Waste (AEPW) was launched with a mission to “Eliminate plastic waste in our environment.” It plans to invest $1.5 billion over the next five years.

Recognizing that the majority of plastic waste comes from developing countries with insufficient waste management and recycling facilities, AEPW will be the first partnership to prioritize improving recycling capacity and infrastructure rather than making products easier to recycle.

AEPW claims over 25 corporate supporters, including Procter & Gamble, Shell, Total, Veolia and Suez. Notably, AEPW's Chair is David Taylor, who is also President and Chief Executive of Procter & Gamble, who said “This new alliance is the most comprehensive effort to date to end plastic waste in the environment. I urge all companies, big and small and from all regions and sectors, to join us.”

[Image Credit: © Alliance to End Plastic Waste]

MARKET NEWS

CPG Companies Face Rising Costs As They Responds To Public Anger Over Pollutive Packaging

CPGs typically spend 5% to 10% of revenues on packaging but this will rise as they shift from single-use plastics to more sustainable alternatives. Leading CPGs, such as Coca-Cola, Nestlé and Unilever, are committed to making their packaging 100% recyclable by 2025, a process that requires costly investment on a number of fronts. But costs will also rise as these companies are made responsible for cleaning up plastics they do use, a shift called Extended Producer Responsibility. Various countries are legislating for EPR, and the U.K., for example, indicated in a December strategy paper they it may require producers to cover 100% of disposal costs, up from 10% today.

CPGs typically spend 5% to 10% of revenues on packaging but this will rise as they shift from single-use plastics to more sustainable alternatives. Leading CPGs, such as Coca-Cola, Nestlé and Unilever, are committed to making their packaging 100% recyclable by 2025, a process that requires costly investment on a number of fronts. But costs will also rise as these companies are made responsible for cleaning up plastics they do use, a shift called Extended Producer Responsibility. Various countries are legislating for EPR, and the U.K., for example, indicated in a December strategy paper they it may require producers to cover 100% of disposal costs, up from 10% today.This shift is being driven by growing public outrage at pollutive packaging, but also major policy shifts. In 2019, China, which had for years imported 45% of the world’s plastic trash, is scheduled to ban imports of single-use and low-grade plastic. This puts the burden on disposal back onto the sourcing countries, which are imposing new regulations on plastic use as well as reassigning responsibility for plastic disposal.

Brands Blindsided By Shifting Consumer Opinion, Yet May Struggle To Switch To Plastic Alternatives

The speed and vehemence with which consumers turned against plastic straws is a cautionary lesson for brands. Media attention has put brands that use plastic (almost all brands), and especially those that use straws, in a difficult situation. Most have responded with announcements promising alternatives in a year or more and meanwhile are busy securing options.

The speed and vehemence with which consumers turned against plastic straws is a cautionary lesson for brands. Media attention has put brands that use plastic (almost all brands), and especially those that use straws, in a difficult situation. Most have responded with announcements promising alternatives in a year or more and meanwhile are busy securing options.

Euromonitor notes that plastic packaging accounts for “63% of global packaging for food, beverage, beauty, home care and pet food products”, underlining the size of the shift required.

As this shift plays out, alternatives to plastics will grow. Euromonitor expects flexible paper packages to reach 400 billion units in 2022 (a 1.5% CAGR), and folding cartons to reach 500 billion units by 2022 (a 2.5% CAGR). Metal beverage cans and glass bottles are also projected to grow but not as fast.

Notably, many ‘alternatives’ to plastic are plastic-based – PET bottles, thin walled plastic containers and HDPE bottles. As companies see the enormities of the challenge, perhaps they’ll push for a more nuanced approach. Instead of a plastic-free world, Euromonitor’s Industry Manager of Packaging Rosemarie Downey wonders whether a more realistic target is a plastic waste-free world: “It is important not to overlook plastic’s valuable contribution…,” she said, adding that there are “inherent protective and resource-efficient benefits afforded by plastic in preventing food waste.”

[Image Credit: © Stefan Schweihofer (stux)]

PACKAGING REDESIGNS

Lightweight Packaging Boosts Sustainability Goals And Prospects For Online Sales

In January 2019, Lucozade Ribena Suntory (LRS) will launch a lightweight redesign of its Ribena bottles, an effort the company estimates will reduce plastic use by some 325 tonnes a year. The company has for ten years been using 100% post-consumer recycled plastic for its Ribena, saving about 40,000 tonnes of virgin plastic. The move follows a trial that tested performance of a lightweight 500ml bottle, its bestselling line. LRS has signed WRAP’s UK Plastic Pact that commits it to stop unnecessary single-use plastic packaging by 2025, compost or recycle 70% of its plastic packaging and ensure at least 30% of its plastic packaging is recycled. The industry continues to face pressure to improve its performance amid news that of the two billion cartons purchased in the UK each year, just 10% are recycled.

In January 2019, Lucozade Ribena Suntory (LRS) will launch a lightweight redesign of its Ribena bottles, an effort the company estimates will reduce plastic use by some 325 tonnes a year. The company has for ten years been using 100% post-consumer recycled plastic for its Ribena, saving about 40,000 tonnes of virgin plastic. The move follows a trial that tested performance of a lightweight 500ml bottle, its bestselling line. LRS has signed WRAP’s UK Plastic Pact that commits it to stop unnecessary single-use plastic packaging by 2025, compost or recycle 70% of its plastic packaging and ensure at least 30% of its plastic packaging is recycled. The industry continues to face pressure to improve its performance amid news that of the two billion cartons purchased in the UK each year, just 10% are recycled.

Müller said it will roll out a new lightweight recyclable milk cap that uses 13% less plastic. The company, which is Britain’s leading producer of branded and private label fresh milk, cream, butter and ingredients, estimates the new cap will save 300 tonnes of plastic every year. In a statement, the company highlighted its efforts to use recyclable material and said it aims to increase the user of recycled plastic in its bottles to 50% by 2020. Patrick Müller, CEO of Müller Milk & Ingredients, said “we have removed 10,000 tonnes of plastic from our milk bottles since 2016.”

Consumer goods companies are realizing that lighter yet more robust packaging helps sales online, making products more economical and profitable to ship and also lowering breakage risk. P&G designed its Tide Eco-Box especially for ecommerce and claims it contains less packaging, 60% less plastic and 30% less water than the current 150 oz Tide press-tap. Especially important for ecommerce, it doesn’t require any secondary re-boxing or bubble wrap, is lighter because of its ultra-compacted formula and takes up less space because of its boxed design.

Earlier in 2018, Seventh Generation launched packaging redesigned for ecommerce, using a compact plastic bottle less than 9 inches tall and rectangular in shape to aid more efficient packing. Also, the bottle has no measuring cup and instead uses a cap that squirts the correct amount needed for a single load. The bottle weights just 1.6 pounds, 5 pounds lighter than its standard 100 ounce bottle, yet the concentrated formula washes the same 66 loads. Seventh Generation tested the design to ensure it would withstand shipping and accidental drops.

With Amazon’s rising power, expect to see this more often. The company can drop or deprioritize products that are too costly to ship, exposing slow to respond manufacturers.

[Image Credit: © Proctor & Gamble]

POLICY, REGULATION & LEGAL

ECHA Proposes Restrictions On Intentionally Added Microplastics

.png&width=125&height=51) The European Chemicals Agency (ECHA) is proposing a restriction on intentionally adding microplastics to mixtures. ECHA, an EU agency that manages the technical and administrative aspects of the EU regulation called REACH, Registration, Evaluation, Authorisation and Restriction of Chemicals, undertook a study and found potential for adverse effects or bioaccumulation. It estimated that a restriction could reduce microplastics emissions by about 400 thousand tonnes over 20 years.

The European Chemicals Agency (ECHA) is proposing a restriction on intentionally adding microplastics to mixtures. ECHA, an EU agency that manages the technical and administrative aspects of the EU regulation called REACH, Registration, Evaluation, Authorisation and Restriction of Chemicals, undertook a study and found potential for adverse effects or bioaccumulation. It estimated that a restriction could reduce microplastics emissions by about 400 thousand tonnes over 20 years.Any restriction would impact a wide range of consumer and professional products in multiple sectors, including cosmetic products, detergents and maintenance products, paints and coatings, construction materials and medicinal products, as well as various products used in agriculture and horticulture and in the oil and gas sectors.

Any legislation is over two years away. ECHA’s scientific committee will review the proposal for 15 months then send an opinion to the European Commission that will have three months to prepare legislation, which could take eight months to come into force.[Image Credit: © European Chemicals Agency]

UK Explores Series Of Policies Measures To Combat Plastic Use

The UK government launched a series of consultations to overhaul the waste system, cut plastic pollution, and move towards a more circular economy.

The UK government launched a series of consultations to overhaul the waste system, cut plastic pollution, and move towards a more circular economy.The consultations build on commitments made in the government’s Resources and Waste Strategy published in December, and aim to provide detail on plans to make packaging producers pay the full cost of dealing with their waste, to introduce a consistent set of materials collected across England from households for recycling, and bring in a Deposit Return Scheme (DRS) for cans and bottles.

On the same day, the government also launched its consultation on introducing a world-leading tax on plastic packaging which does not meet a minimum threshold of at least 30% recycled content, subject to consultation, from April 2022. Such a tax would address the current issue of it often being cheaper to use new, non-recycled plastic material despite its greater environmental impact.[Image Credit: © Wiki Commons]

INNOVATION & TECHNOLOGY

Bioplastics Making Headway, Start To Tap Niche Markets

After reviewing liquid retention properties of tomatoes, watermelon, tapioca and coconuts, startup Skipping Rocks Lab selected seaweed as the basis for a sustainable wrapping called Ooho. With support of an EU grant, the company has manufactured packaging for a range of ingestibles, including water for use at running events, sauces for takeouts, and juice and alcohol shots. Shelf-life is limited – after a few days the packaging starts to shrivel – and it isn’t strong enough for wrapping household goods. Instead, the company is targeting ‘instant consumption’, such as fast-food, festivals and events.

In a separate effort, Tel Aviv University is working on using microorganisms that feed on seawater algae to create fully biodegradable ‘plastic’. This bioplastic is already produced in commercial quantities using plants grown with fresh water. The goal is to use ocean-sourced microorganisms. In a separate development, the United States Department of Energy made a $2 million grant to UC San Diego to support efforts to produce algae-based plastic polymers cost-effectively.

Startups offering sustainable alternatives will be boosted by emerging regulation that seeks to limit plastic consumption. For example, in October 2018, the EU decided to prevent use of single-use plastic in food and drinks containers by 2021. Also, research continues to raise the profile of plastics as an environmental issue. Ellen MacArthur Foundation, for example, recently estimated that by 2050 the weight of plastic in the oceans will exceed the weight of fish.

[Image Credit: © Skipping Rock Lab]

Nestlé Waters North America Boosts Access To rPET But Raises Concerns About Long-Term Supply Sufficiency

As part of its commitment to using 25% recycled plastic across its US domestic portfolio by 2021 and 50% by 2025, Nestlé Waters North America (NWNA) has contracted with recycled polyethylene terephthalate (rPET) suppliers to nearly quadruple its use of food-grade rPET in less than three years.

As part of its commitment to using 25% recycled plastic across its US domestic portfolio by 2021 and 50% by 2025, Nestlé Waters North America (NWNA) has contracted with recycled polyethylene terephthalate (rPET) suppliers to nearly quadruple its use of food-grade rPET in less than three years.Toward the end of 2018, NWNA said it would expand its relationship with rPET supplier Plastrec Inc., Quebec, as well as boost its partnership with CarbonLite Industries LLC in Los Angeles, CA.

But even with these enhanced relationships and secured supply, NWNA is concerned about long-term availability of food-grade rPET. The company says it is encouraging suppliers to boost capacity but believes more needs to be done to ensure sufficient supply.

[Image Credit: © Nestlé Waters North America]

EMERGING IDEAS, THEMES & TRENDS

Key UK Retailers Start To Go Plastic Free

Following the success of its 'naked' stores in Germany and Italy, Lush announced it would trial its first plastic-free shop in the UK. The store will not sell any products in plastic packaging and since about half of Lush’s products are plastic-free, product assortment at the store will be limited. It will have solid soap bars, bath bombs, and bar versions of some popular shampoos, conditioners, shower gels and body lotions. It will also have a range of plastic-free cosmetics such as lip scrubs and lipstick.

In a bid to reduce the plastic it uses, Marks & Spencer announced it would launch over 90 lines of loose fruit and vegetables in a three-month trial at a London store. Produce is offered completely free of plastic packaging. Hard fruit and veg are offered loose and more perishable soft fruits and berries are in compostable punnets. M&S has removed “best before” date labels and has provided greengrocers to advise consumer of how best to preserve produce. The trial is part of the company’s target of becoming a zero-waste business by 2025.

Copyright 2026 Business360, Inc.